Key Takeaways

- Auto advertising would have spent an estimated $29.4 million [CAD] in 2025 had the tariffs not gone into effect

- This impact alone reduced Canada’s overall ad market growth by 0.43 percentage points in 2025

- Q4’25, while marginally improving over Q2 and Q3 will likely be -6 to -10% YoY to Q4’24

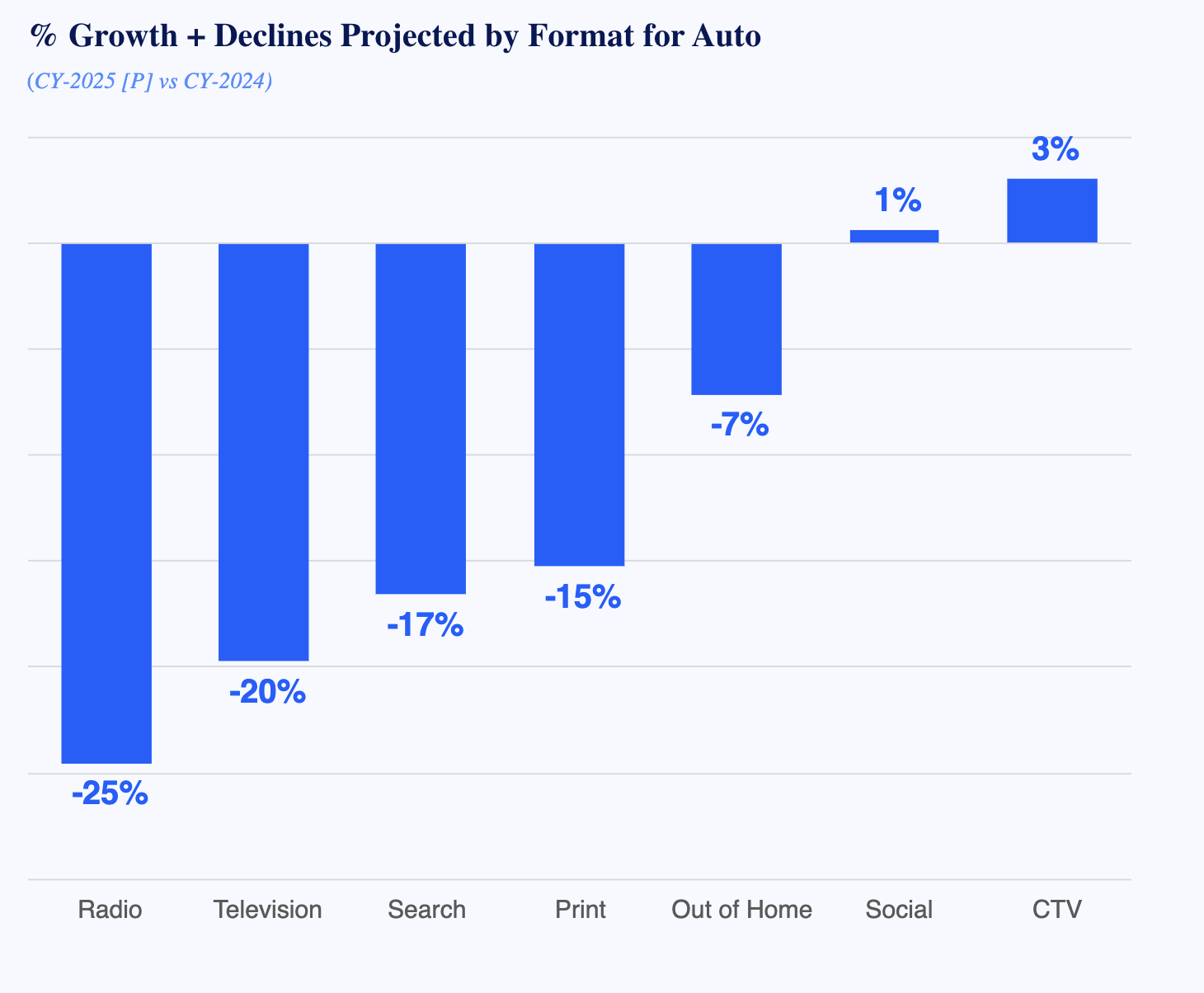

- Despite these declines, some media types like Social and CTV are projected to finish the year up YoY for Auto Spend

- Radio, Television suffered the greatest declines tied to tariffs

In March of this year, President Trump issued a slew of Executive Orders placing tariffs on a wide range of products from around the world. In particular, an initial tariff of 25% was put into effect on passenger vehicles starting on April 3rd for all imported cars and May 3rd for car parts. While some exemptions exist under USMCA, the impact of tariffs have been felt across North America. With some parts of a car passing the US and Canadian borders 2, 3 or even 4 times before the car is fully made reflects how deeply intwined the auto industry has become and how complicated the notion of what is made where.

The Canadian automotive industry is roughly 4% of GDP and the second largest export (92% goes the US). So it is no surprise the profound economic impact tariffs have had on the Canadian economy. Especially the advertising economy, where the automotive industry is a sizable 15% of all advertising in Canada [Guideline].

While the Auto industry has been cutting back ad spend in Canada, the tariffs have had a profound impact, likely reducing ad spend by an additional $29 million in 2025.

The losses were accelerated post traditional Canada Day as dealers, vehicle makers spent on promotions and incentives before significantly scaling back advertising during the rest of the summer.

And while the declines have been felt across the advertising industry, some bright spots remain. We estimate that CTV and Social in particular will see growth in 2025. These formats have benefited from audience growth coupled with ease of targeting key groups like Auto Intenders. Radio and Television have suffered for the opposite reason, with limited addressability and stagnant consumption.

Search is a bit of an outlier but was declining for Auto going into 2025. Our current hypothesis is that Search has been seeing declining ROAS as GenAI summaries have made things like marketing or search optimization tactics less effective. The tariffs probably accelerated a shift away from marketing there and into areas that continue to perform well like Social and CTV.

While it is hard to predict the future, our data seems to be pointing to some of the declines easing in Q4 (estimating -6 to -10% compared to -13% in Q3). The Canadian economy appears to be improving and will likely see GDP growth for the year. The labour market is trending better after the initial shocks of auto plant closures. While the auto category will be down in ad spend for the year, there is some optimism that 2026 could bring ad spend more flat after a difficult 2025. But if this year has been anything to go by, it will be hard to predict what comes next for the Canadian auto industry and beyond.

For media inquiries or to learn more about Guideline’s latest insights, please contact our team at press@guideline.ai. We’re happy to provide additional commentary, data, or interview opportunities.

Guideline will be hosting an intimate Executive Luncheon, highlighting insights from the Canadian advertising, data, and technology sectors. Join senior leaders for a private discussion on the health of the Canadian media market and how AI, tariffs, and emerging trends are shaping Guideline’s 2026 media outlook. You can RSVP by emailing our VP, Data, North America, Darrick Li, at darrick.li@guideline.ai to secure your spot.

.png)