Key Takeaways

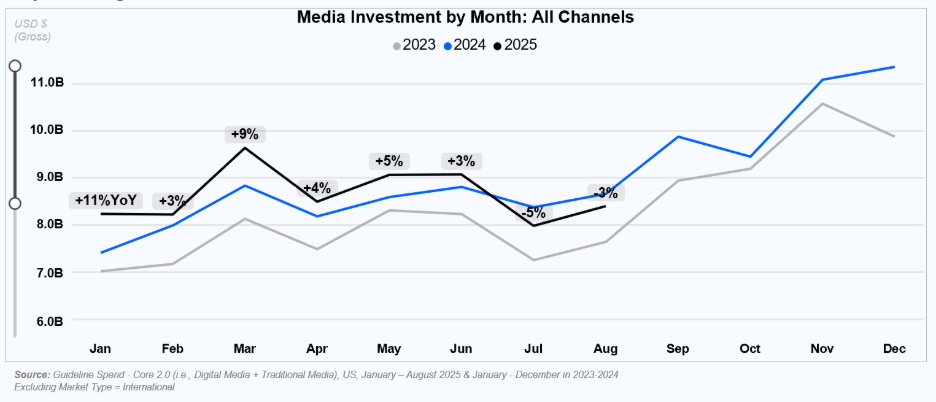

- U.S. media spend contracted -3% YoY, marking the second straight monthly drop

- Excluding the absence of Olympic dollars, August spend posted a modest +4% YoY increase

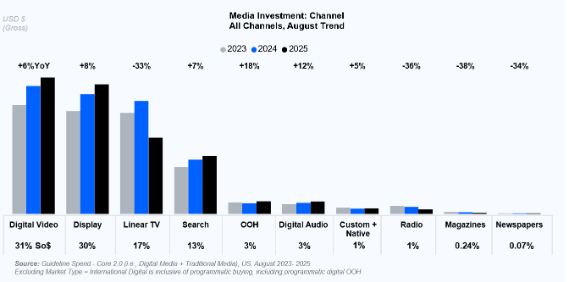

- Digital rose +8% YoY, while Traditional media plunged -29% YoY

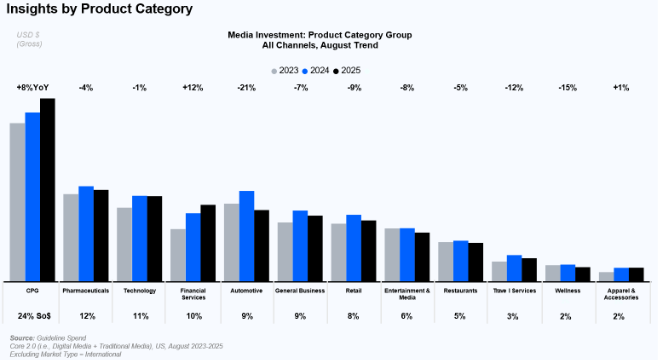

- Automotive spend fell -21% YoY and Retail declined -9% YoY, reflecting cost pressures from higher import tariffs

US media spend in August reflected not only the absence of Olympic dollars but also broader macroeconomic and policy pressures. The Trump administration’s reciprocal tariffs, which took effect early in the month, raised import costs and squeezed margins across automotive and retail, prompting budget pullbacks. Inflationary pressures and supply-side constraints kept effective media rates elevated, adding further strain. While Digital channels such as Social and Search continued to absorb demand, Traditional media came under increasing pressure. Together, these forces fostered advertiser caution, leading brands to reallocate budgets toward more efficient, performance-driven channels and away from large, discretionary campaigns.

US media spend declined -3% YoY in August 2025, marking a second straight monthly drop and reversing the +13% YoY gain seen in the same month last year. The absence of Summer Olympics advertising weighed heavily on results. Excluding the Olympic effect, August total spend rose a modest +4% YoY, but including it, overall spend fell -3% YoY.

Digital remained resilient but showed signs of cooling, growing +8% YoY in August 2025 compared to +16% YoY in August 2024. Growth persisted across all major formats— Digital Video climbed +6% YoY, Display +8% YoY, and Search +7% YoY—but each slowed from the double-digit gains of last summer.

Traditional media endured a steeper pullback, dropping -29% YoY from the +8% YoY increase recorded last August. Linear TV led the decline, tumbling -33% YoY after +12% YoY growth a year ago. Excluding the Olympic effect, August Linear TV spend declined -17% YoY. Out of Home stood as the lone exception, up +19% YoY.

Most Product Category Group reduced their media investments in August, though CPG, Financial Services, and Apparel & Accessories managed to post.

On a year-to-date basis through August, US media spend was up+ 3% YoY, slowing down from +17% YoY pace over the same period in 2024.